Good Morning, Noble Managers! It’s Wednesday, July 23.

Topic: Economic Analysis | Macroeconomic Indicators | Strategic Decision-Making

For: B2B and B2C Managers.

Subject: Macro Signals → Practical Application

Concept: Read Fed policy, unemployment, and inflation to anticipate market shifts

Application: Adjust pricing, hiring, and inventory before competitors react

Don’t keep us a secret. Share this newsletter with friends (copy URL here).

TL;DR:

Why Fed rate changes, unemployment, and inflation predict your market’s next move

How to use Okun’s Law, Phillips Curve, and PPI to act 6–12 months early

2025 outlook: Tariffs and sticky inflation signal cautious strategies—plan now

Introduction

Fed rate hikes or cuts aren’t just news. They’re signals that shape your pricing, hiring, and demand forecasts.

In July 2025, with 3.1% PCE inflation (J.P. Morgan), 3.9% unemployment (BLS), and 25% tariffs on $200B in Chinese imports, waiting for quarterly reports is too late.

In the last two weeks, we explored the yield curve to spot recessions (link here) and money supply to monitor M2 and MMMFs for demand shifts (link here).

Now, we complete the trifecta with interest rates, inflation, and unemployment, giving you a full view of the economy’s pulse to outsmart competitors.

Macro 101: How the Fed Shapes Your Market

The Fed’s Dual Mandate:

The Fed balances two goals:

Stable Prices: Keeping inflation (e.g., 3.1% PCE, June 2025) in check.

Maximum Employment: Supporting jobs (3.9% unemployment, BLS).

This means every policy decision is a balancing act: Raise rates too slowly and risk runaway inflation; raise them too quickly and risk a recession.

What this means for you:

A rate hike signals the Fed prioritizes inflation over unemployment.

A rate cut signals a focus on boosting jobs and growth.

Okun’s Law:

For every 1% unemployment increase, GDP drops ~2%.

This relationship gives you a simple, data-backed way to estimate how shifts in the labor market might impact your business.

Example: Unemployment jumping from 3.9% to 4.9% implies a 2% drop in economic output.

If your sales rely on discretionary spending, prepare for softer demand.

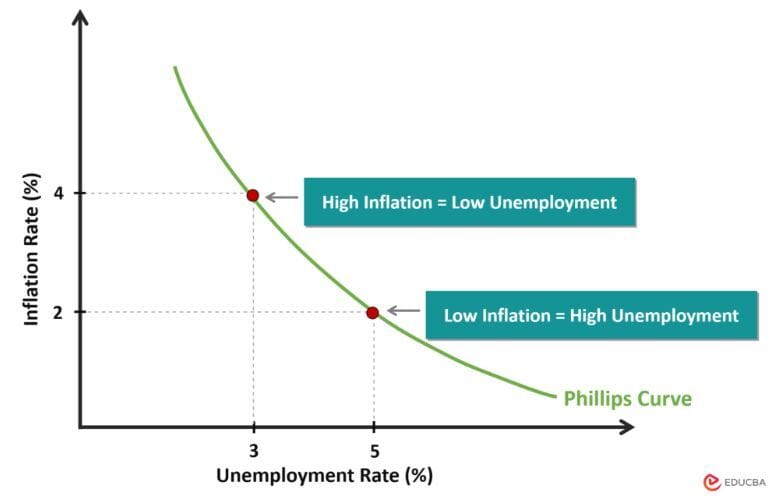

Phillips Curve:

The Phillips Curve shows a fundamental tradeoff: when unemployment is low, inflation usually rises—and vice versa.

Low unemployment (e.g., 3.9%) drives wage hikes, pushing inflation.

If workers expect 4% inflation, they’ll demand higher pay, forcing you to raise prices or cut margins.

Other Relevant Signals:

Producer Price Index (PPI): Tracks wholesale input costs, rising before CPI. A spike (e.g., 3.2% YoY, June 2025) warns of vendor price hikes.

Employment Cost Index (ECI): Measures wage and benefit growth (4.1% YoY, Q2 2025). Helps forecast payroll costs for budgeting.

Aha Moment:

Fed actions, unemployment, and inflation aren’t abstract. They dictate your customers’ spending, suppliers’ prices, and employees’ wage demands. Track them to act first.

The Problem: Macro Signals Predict Your Next Challenge

Fed decisions ripple with a lag, creating demand swings or cost pressures.

Lower rates → cheaper borrowing → more investment and consumer spending.

Higher rates → tighter credit → slower hiring, lower production.

But these effects are delayed:

Money supply shrinks immediately

Production dips after ~6 months

Unemployment rises around month 9

Inflation drops slowly, often after a full year

In 2020, low rates (0.25%, FRED) and a $1.7T M2 surge (FRED) fueled demand, causing shortages for unprepared firms. By 2021, rising unemployment (6.3%, BLS) and Fed rate hike signals (FOMC minutes) warned of softening demand, yet many overstocked, leading to 2022’s surplus losses (e.g., $1B for Target, WSJ). Today, a flattening yield curve (+0.59% 10-2 spread, FRED), slowing M2 growth (4.5%, $21.94T), and tariffs signal cautious demand and rising input costs. Ignoring these risks being outmaneuvered.

Case Study: Tesla’s Strategic Response in 2020

In Q1 2020, Tesla’s planning team, leveraging Okun’s Law and the Phillips Curve among other tools, navigated COVID-19’s economic chaos:

Okun’s Law: Unemployment spiked to 14.7% (April 2020, BLS), signaling a 20%+ GDP drop (5.0% in Q1, 32.9% annualized in Q2, BEA). Tesla forecasted weak consumer demand, opting for lean 60-day inventory to preserve $8.1B in cash (Tesla Q1 2020 Report).

Phillips Curve: Pre-COVID low unemployment (3.5%) and modest 1.3% PPI growth (2019, BLS) showed stable supply chains. Anticipating post-crisis cost volatility, Tesla secured battery contracts with CATL and Panasonic in Q1 2020.

Action: Tesla maintained production flexibility, delivering 88,400 vehicles and a $16M GAAP profit in Q1 2020 despite the crisis (Tesla Q1 2020 Report). By Q3, as unemployment fell and GDP recovered, Tesla scaled to 139,300 deliveries—a 57% increase—gaining 25% market share while rivals faced supply chain delays.

Aha Moment:

Okun’s Law and Phillips Curve understanding contributed to let Tesla predict demand and cost shifts 6–12 months early, securing a competitive edge.

The Signals: Your Economic Radar

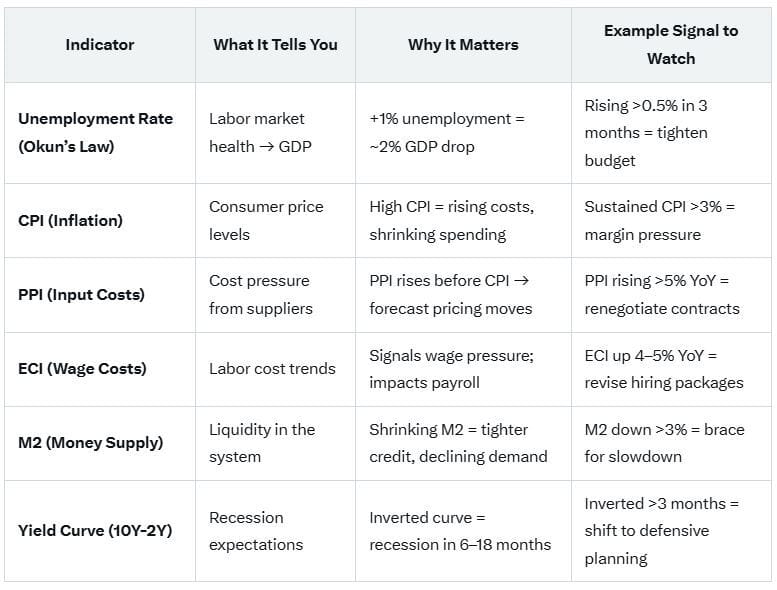

Key Indicators:

Federal Funds Rate (FRED: FEDFUNDS): 4.5% (July 2025), signaling inflation control. A cut could spark demand in 3–6 months.

Unemployment Rate (FRED: UNRATE): 3.9% (June 2025), low but rising slightly, hinting at softening demand.

Producer Price Index (FRED: PPIACO): Up 3.2% YoY (June 2025), warning of supplier price hikes.

Employment Cost Index (FRED: ECI): Up 4.1% YoY (Q2 2025), signaling wage pressure.

M2 Growth (FRED: M2SL): 4.5% ($21.94T, May 2025), below 6.8% average, suggesting cautious spending.

Yield Curve (FRED: T10Y2Y): +0.59% spread (July 2025), flattening, hinting at 40% recession risk.

Why They Matter:

Rate Changes: Hikes tighten credit, slowing hiring; cuts boost investment.

Unemployment: Rising rates (per Okun’s Law) cut GDP, hitting sales.

PPI/ECI: Predict cost increases before they hit your P&L.

M2/Yield Curve: Slow M2 and flattening curve reinforce caution signals.

2025 Context: Sticky 3.1% inflation, 3.9% unemployment, and tariffs (25% on $200B) suggest rising input costs and cautious demand. A Fed rate cut (40% odds, WSJ) could spark growth by Q4.

The Manager’s Macro Playbook: 5 Steps

Use this 3-step playbook each quarter to decode where the economy is headed—and act before competitors.

Step 1: Track These 6 Indicators Monthly

Build a simple spreadsheet with these metrics:

Step 2: Apply These 2 Laws Like a Forecasting Formula

Okun’s Law: Unemployment up 1% = 2% GDP drop → Use for:

Forecasting revenue in B2C/B2B discretionary sectors.

Preemptive hiring/firing decisions.

Adjusting inventory/production cycles.

Example: Unemployment rising from 3.9% to 4.9% signals a 2% output drop, implying a 2–4% sales decline depending on your market.

Phillips Curve: Lower unemployment = higher inflation via wages. Use for:

Timing wage negotiations or bonuses.

Repricing or bundling offers before costs rise.

Predicting price hike viability.

Watch: CPI rising + unemployment falling = prepare for wage demands; wage inflation without productivity = margin squeeze.

Always remember: M × V = P × T. Slow M2 growth = cautious demand.

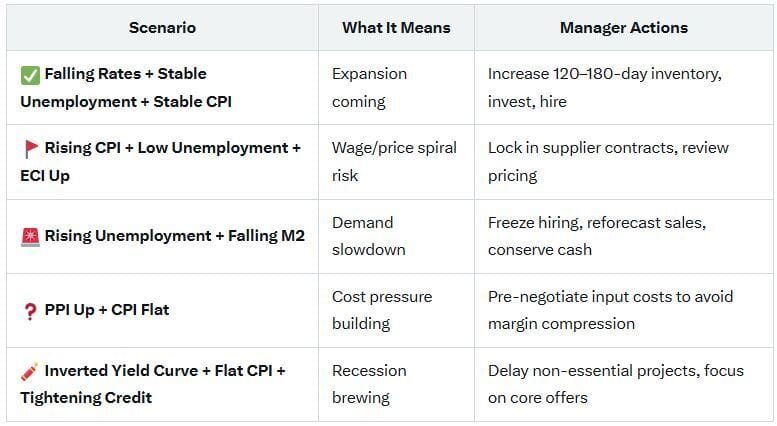

Step 3: Match What You See to What You Should Do

Critical Insights: Lessons from Rate Cycles

In 2020, low rates (0.25%, FRED) and rising PPI (8.6%, BLS) signaled demand surges. Tesla acted early, securing supplies and gaining market share (Bloomberg). In 2021, rising unemployment (6.3%, BLS) and rate hike signals led to surplus losses for unprepared firms. In 2025, with 4.5% rates, 3.2% PPI growth, and tariffs, cautious strategies are key—but a rate cut could spark demand by Q4.

Manager Takeaway: Yellow signals (3.9% unemployment, 3.1% PCE) mean secure supply for tariff-driven cost hikes but stay lean to avoid surplus traps.

Top Links to Deep Dive

Want to go beyond today’s breakdown? Here are the best resources to master this topic:

FRED – https://fred.stlouisfed.org/

BLS – https://www.bls.gov/

BEA – Link here.

FOMC – Link here.

EDUCBA – Phillips Curve Graph Explained. Link here.

Gies College of Business – FIN 571: Money and Banking. Link here.

The Noble Manager – Yield Curve. Link here.

The Noble Manager – M2 and Fed Signals. Link here.

Tesla – SEC Filings. Link here.

Final Thought

Fed signals, unemployment, and inflation are your radar for market shifts. Read them like a Fed Chair, not an economist, to make smarter pricing, hiring, and inventory decisions.

Until next time, keep innovating—and keep it noble!

Filippo Esposito

Founder, The Noble Manager