Good Morning, Noble Managers! It’s Wednesday, July 16.

Topic: Economic Analysis | Money Supply Interpretation | Strategic Planning

For: B2B and B2C Managers.

Subject: Macro Signals → Practical Application

Concept: Use M2, money market funds, and Fed actions to anticipate demand shifts

Application: Turn liquidity signals into plans for inventory, pricing, and capital allocation

Don’t keep us a secret. Share this newsletter with friends (copy URL here).

TL;DR:

Why M2, money market funds, and Fed actions predict shortages or surpluses

How to read liquidity signals and act before markets shift

2025 outlook: Slow M2 growth and tariff risks signal caution—act now

Introduction

Why did so many firms miss the COVID-19 supply crunch or end up with excess inventory by 2023?

The signals—Federal Reserve’s M2 money supply, money market funds, and QE actions—were screaming warnings.

Our yield curve guide (last week, link here) showed how to spot recessions early; now, let’s decode liquidity signals to predict demand surges or slowdowns.

With M2 growth slowing to 4.5% ($21.94T, FRED) and tariffs on $200B in Chinese imports driving shortages, these indicators are your edge for 2025.

Here’s a playbook to navigate shortages, surpluses, and demand shifts like a strategist, not a central banker.

Money Supply 101: Why Liquidity Drives Your Market

What Is the Monetary Base?

Cash + bank reserves created by the Fed show whether money supply growth is “real” (Fed-driven) or credit-based.

In June 2025, the base is $6.1T, flat since 2024 (FRED), signaling no new cash flood.

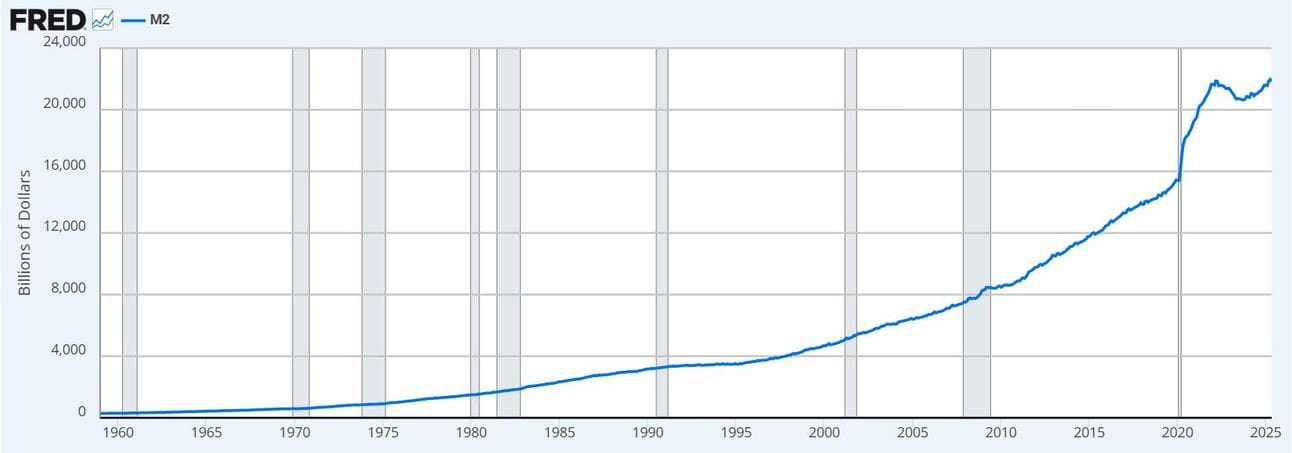

What Is M2?

M1, M2, and M3 are measurements of the United States ’ money supply, known as the money aggregates.

M1 includes money in circulation (Monetary Base) + bank checking accounts.

M2 includes M1 + savings, small time deposits, and retail money market funds.

In May 2025, M2 hit $21.94T, up 4.5% year-over-year, below the 6.8% long-term average (FRED).

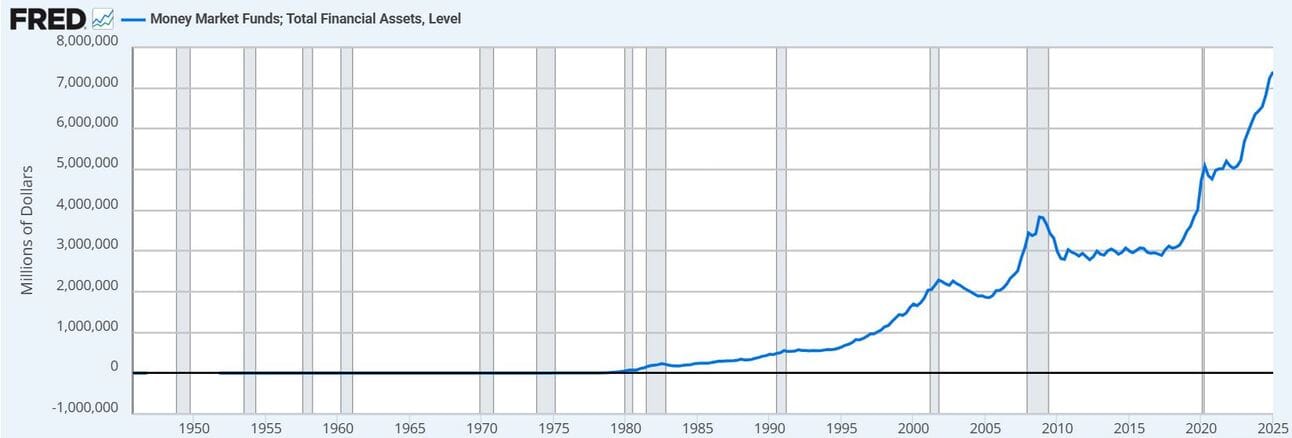

What Are Money Market Funds (MMMFs)?

Low-risk funds holding cash-like assets (e.g., Treasuries).

Assets reached $7.02T in June 2025, up 15% (ICI), showing cash poised for deployment.

The Quantity Theory of Money:

M × V = P × T

(Money Supply × Velocity = Prices × Transactions)

M2 Surge: More money raises prices (P) or output (T).

Low Velocity (V): Money sits idle, delaying inflation.

2025 Context: Velocity is 1.386 (FRED), near historic lows, signaling cautious spending.

Why this matters: M2, monetary base, and MMMFs reveal cash flow in the economy—surges drive shortages; slowdowns risk surpluses. Track these to stay ahead.

Case Study: Pandemic Shortages and Surpluses

In Q2 2020, as COVID-19 froze supply chains, Walmart’s Management read three signals to outmaneuver competitors:

Signal 1: M2 Explosion

Data: M2 surged $1.7T (Feb–Apr 2020, FRED).

Analysis: Per M × V = P × T, a massive M2 jump meant prices (P) would rise if supply (T) was constrained.

Takeaway: Demand for electronics and goods was set to spike, risking shortages.

Signal 2: Monetary Base Surge

Data: Monetary base grew $1.4T, 81% of M2’s increase (FRED).

Analysis: Fed’s QE (Quantitative Easing) and stimulus checks flooded markets with real cash, not just credit.

Takeaway: Cash-rich firms and consumers would compete for scarce goods.

Signal 3: Money Market Fund Spike

Data: MMMFs swelled by $361B (Q2 2020, FRED).

Analysis: Risk-averse investors held deployable cash, ready to snap up supplies.

Takeaway: Competitors would lock in contracts fast, amplifying shortages.

Action: Walmart secured chip and consumer goods contracts early, avoiding 8–12 week delays that hit rivals. By Q3 2020, they gained market share.

2022–2023 Reversal

The same indicators flipped:

M2 Slowdown: Growth dropped to 2% by late 2021 (FRED).

Yield Curve Inversion: Signaled recession in early 2022 (T10Y2Y).

Fed Tightening: Rates hit 5% by mid-2022 (FRED).

Result: Demand for apparel and discretionary goods collapsed, leaving Target with $1B in markdown losses from overstocking (CNBC).

Why this matters: M2, monetary base, and MMMFs predict demand waves—surges cause shortages; slowdowns create surpluses. Spot these early to act before competitors.

The Signals: Your Economic Radar

Key Indicators:

Monetary Base (FRED: BOGMBASE): $6.1T (June 2025), flat, showing no new Fed injections.

M2 Growth (FRED: M2SL): 4.5% YoY ($21.94T, May 2025), below 6.8% average.

MMMFs (FRED: MMMFFAQ027S): $7.02T (June 2025), up 15%, signaling deployable cash.

M2 Velocity (FRED: M2V): 1.386, near lows, indicating hoarding.

Yield Curve (FRED: T10Y2Y): +0.59% spread (July 2025), normalized but flattening, hinting at recession risk.

Why They Matter:

M2/Base Surge: Signals demand spikes (e.g., 2020 shortages).

MMMFs Growth: Shows competitors’ readiness to act.

Low Velocity: Warns of delayed spending, risking surpluses.

Yield Curve Link: A flattening curve reinforces slowdown signals from low M2 growth.

2025 Context: Slow M2 growth, high MMMFs, low velocity, and tariffs (25% on $200B, June 2025) suggest cautious demand with potential shortages for specific categories of goods.

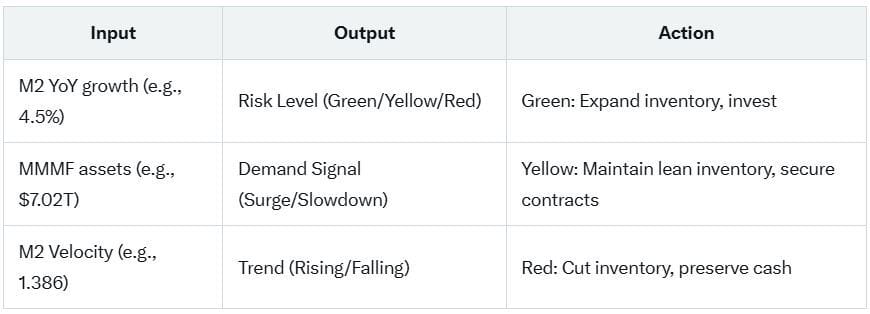

Tactical Tool: Liquidity Signal Scorecard

Our Liquidity Signal Scorecard helps you assess demand risks and act.

What the Tool Does:

Steps:

Check Signals: Visit FRED for M2SL, BOGMBASE, MMMFFAQ027S, M2V.

Classify Risk:

Green: M2 growth >6%, velocity rising → Expand confidently.

Yellow: M2 growth 3–6%, velocity flat → Proceed cautiously.

Red: M2 growth <3%, velocity falling → Protect cash flow.

Track Trends: Compare monthly data to spot surges or slowdowns.

Example: May 2025 data (M2: 4.5%, MMMFs: $7.02T, velocity: 1.386) gives a Yellow risk level, recommending lean inventory and supplier contracts.

The Manager’s Liquidity Playbook: 5 Steps

Turn liquidity signals into a competitive edge with this 5-step playbook:

Step 1: Monitor Monthly

Check M2, monetary base, MMMFs, and velocity on FRED’s first Monday. Look for >3% month-over-month changes.

Step 2: Apply MV = PT

M2/base surge = demand building, shortages likely.

High MMMFs = competitors ready to deploy cash.

Low velocity = delayed impact, but bigger when it hits.

Step 3: Cross-Reference Business Cycle

Early expansion + M2 growth: Build 120–180-day inventory, raise prices.

Late expansion + M2 slowdown: Maintain 90-day inventory, secure contracts.

Yield curve flattening/inversion + M2 decline: Cut to 60-day inventory, save cash.

Step 4: Adjust Operations

Surge (Green): Secure supply contracts, raise prices, hire, invest.

Caution (Yellow): Maintain lean inventory, hedge pricing with escalators, pause big investments.

Slowdown Red: Reduce inventory, delay capex, preserve cash, renegotiate contracts.

Step 5: Communicate and Time Moves

Tell your team, “Liquidity signals show [surge/caution/slowdown]. We’re [actions].” Act 6 months before signals hit mainstream news for maximum advantage.

Downloadable Tool: Use our Liquidity Action Checklist.

Critical Insights: Lessons from COVID

In 2020, the Fed’s $1.7T M2 surge and $1.4T base injection (FRED) created shortages (chips, containers).

Smart firms acted:

Manager Takeaway: 2025’s Yellow signals (4.5% M2, flat velocity, tariffs) echo 2020’s early warnings—secure supply now, stay lean to avoid surplus traps.

What’s Your Liquidity Risk Level?

Take our Liquidity Signal Scorecard link and share your risk level (Green, Yellow, Red) on X.

Are tariffs or low velocity shaping your 2025 plans? Join the discussion!

Top Links to Deep Dive

Want to go beyond today’s breakdown? Here are the best resources to master this topic:

The Noble Manager – How to Spot Recession Signals in Treasury Yields Before Your Competitors Do. Link here.

Liquidity Signal Scorecard - Web App. Link here.

FRED M2 – fred.stlouisfed.org/series/M2SL

FRED Monetary Base – fred.stlouisfed.org/series/BOGMBASE

FRED MMMFs – fred.stlouisfed.org/series/MMMFFAQ027S

FRED Velocity – fred.stlouisfed.org/series/M2V

The Brookings Institution – What did the Fed do in response to the COVID-19 crisis? Link here.

Gies College of Business – FIN 571: Money and Banking. Link here.

Final Thought

M2, monetary base, and money market funds are your radar for demand shifts. Read them like a manager, not a central banker, to turn economic signals into strategic wins—before competitors react.

Until next time, keep innovating—and keep it noble!

Filippo Esposito

Founder, The Noble Manager