Good Morning, Noble Managers! It’s Wednesday, September 3.

Topic: Economic Analysis | Debt Crisis Management | Strategic Decision-Making

For: B2B Managers.

Subject: Debt Crisis Signals → Practical Application

Concept: Decode rising U.S. Treasury yields, inflation, and debt crisis risks to anticipate market shifts

Application: Secure financing, renegotiate contracts, and hedge operational risks before competitors react

Don’t keep us a secret. Share this newsletter with friends (copy URL here).

TL;DR:

Bond markets globally are rejecting central bank rate cuts, pushing long-term yields higher despite easing

Ray Dalio warns of U.S. "debt-induced heart attack" within 3 years as refinancing needs hit $9 trillion

Historical patterns (1970s, 2008, current UK/Japan) show successful companies act early on debt crisis signals

Introduction

Central banks are cutting rates, but bond markets aren't buying it.

The Bank of England cut rates five times in 12 months, yet 30-year yields hit 27-year highs.

Japan's government bonds trade 30 times higher than 2019 levels.

The U.S. faces similar pressure as Ray Dalio warns of a looming "debt-induced heart attack."

For managers, this isn't abstract economic theory. It's the early warning system for higher borrowing costs, supplier price hikes, and currency volatility that will hit your P&L in the next 6-12 months.

This newsletter connects global debt signals to practical management decisions, using historical patterns and real-world examples to help you act before your competitors recognize the threat.

The Debt Crisis Pattern: Why Rate Cuts Aren’t Working

The Central Bank Trap:

When governments have massive debts, central banks face an impossible choice:

Cut rates to help the economy → Bond investors demand higher yields for inflation risk

Raise rates to fight inflation → Government can't afford debt payments

Global Evidence:

UK: 5 rate cuts led to 27-year high bond yields (5.70%)

Japan: Yields at 3.20%, up 30x since 2019 despite stimulus

US: $1 trillion annual interest payments with $9 trillion refinancing needs by 2026

Why This Matters for Managers:

Short-term rates may fall, but long-term borrowing costs are rising. If your business relies on long-term financing, equipment loans, or has variable-rate debt, costs are heading up regardless of Fed policy.

Historical Playbook: How Smart Companies Navigate Debt Crises

Case Study: IBM’s 2008 Response

When 30-year Treasury yields spiked to 4.72% and the dollar weakened 12% against the euro, IBM took four decisive actions:

Secured Fixed-Rate Financing Early: Locked in $12 billion at sub-5% rates before yields climbed higher

Diversified Supply Chain: Shifted 25% of sourcing to domestic suppliers, reducing currency exposure by 5%

Proactive Pricing: Raised hardware/software prices 3-5% ahead of inflation, maintaining margins

Expanded Currency Hedging: Increased hedging program by 20%, protecting $300M in net income

Result: While competitors like Dell saw 13% revenue drops in 2009, IBM's Systems division grew 2%.

The Pattern:

Companies that recognize debt crisis signals early and take defensive action outperform those that wait for obvious distress signals.

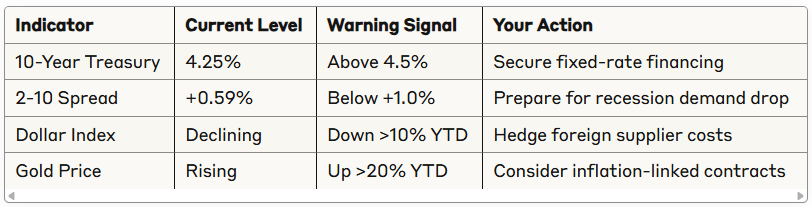

Your Debt Crisis Dashboard: 4 Key Indicators

Track these monthly to anticipate cost pressures:

The Manager’s 3-Step Response Framework

Step 1: Financial Defense (Next 30 Days)

Review all variable-rate debt and refinancing deadlines

Get quotes for fixed-rate alternatives before yields rise further

Audit foreign currency exposures in your supply chain

Build 90-day cash buffer for operational flexibility

Step 2: Contract Strategy (Next 90 Days)

Renegotiate supplier contracts with inflation escalators

Lock in critical inventory at current prices where possible

Review customer contracts for price adjustment mechanisms

Consider shorter-term agreements to maintain pricing flexibility

Step 3: Competitive Positioning (Next 6 Months)

Focus on products/services with pricing power

Reduce dependence on credit-sensitive customers

Build direct supplier relationships to avoid middleman markups

Invest in operational efficiency to offset margin pressure

Critical Insights: 3 Lessons from Debt Crises

Lesson 1: Bond Markets Lead Policy Central banks follow markets, not the reverse. When long-term yields rise despite rate cuts, credit conditions are tightening regardless of policy intentions.

Lesson 2: Currency Debasement Is the Escape Valve Governments facing unsustainable debt typically choose inflation over default. Plan for persistent inflation, not the temporary spikes many expect.

Lesson 3: Early Movers Win IBM's 2008 success came from acting on early signals. By the time debt crises make headlines, defensive moves become expensive or impossible.

What’s Your Debt Crisis Risk Level?

Rate your exposure (1-3 scale):

Variable-rate debt: 1 (minimal) to 3 (significant)

Foreign supplier dependence: 1 (domestic) to 3 (mostly overseas)

Credit-sensitive customers: 1 (essential services) to 3 (discretionary)

Long-term contracts: 1 (flexible pricing) to 3 (fixed pricing)

Score 8-12: High risk - immediate defensive action required Score 4-7: Moderate risk - structured preparation needed Score 1-3: Lower risk - strategic positioning opportunity

Top Links to Deep Dive

Want to go beyond today’s breakdown? Here are the best resources to master this topic:

Ray Dalio – X Post. Link here.

CNN – The US is transforming into a 1930s-style autocracy, says billionaire Ray Dalio. Link here.

The Noble Manager – How to Spot Recession Signals in Treasury Yields Before Your Competitors Do. Link here.

The Noble Manager – Win 2025 with Fed Signals for Smarter Decisions. Link here.

The Kobeissi Letter – X Thread. Link here.

Oguz O. | 𝕏 Capitalist – X Thread. Link here.

Gies College of Business – FIN 571: Money and Banking. Link here.

IBM – 2008 Annual Report. Link here.

Final Thought

Debt crises unfold slowly, then suddenly. The signals are already visible in bond markets globally. The question isn't whether higher costs are coming—it's whether you'll be prepared when they arrive.

Smart managers use early warning systems. The yield curve, currency markets, and commodity prices are flashing caution signals now. Act while your competitors are still focused on quarterly earnings calls.

Until next time, keep innovating—and keep it noble!

Filippo Esposito

Founder, The Noble Manager