Good Morning, Noble Managers! It’s Wednesday, August 27.

Topic: Financial Strategy | Capital Investment | Trade Adaptation

For: B2B and B2C Managers.

Subject: Capital Budgeting (Part 3) → Practical Application

Concept: Evaluate local production with capital budgeting

Application: Use Profitability Index and Equivalent Annual Cost to optimize efficiency

Don’t keep us a secret. Share this newsletter with friends (copy URL here).

TL;DR:

EU–US deal signals new trade dynamics, exposing smaller importers.

PI and EAC help managers cut risk and improve efficiency.

2025: Use these tools to stay resilient as tariffs reshape the market.

Introduction

The global trade landscape is heating up. The U.S. and EU appear close to striking a deal to channel more investment into American soil, while the Trump administration doubles down on big-government alliances with major corporations. The result? Small and mid-sized B2B importers remain exposed to volatile markets and unpredictable trade shifts.

In this climate, capital budgeting isn’t just a nice-to-have—it’s a survival tool.

This final installment of our three-part series spotlights Profitability Index (PI) and Equivalent Annual Cost (EAC), rounding out the essential methods for smarter investment decisions. Parts 1 and 2 covered NPV ($13,722 at 10%), IRR (12.5% vs. 10%), Payback Period (2.86 years), and Discounted Payback (3.5 years).

Now it’s time to master PI and EAC—and complete your decision-making toolkit for 2025’s trade challenges.

Understanding PI and EAC: Your Optimization Toolkit

The Profitability Index (PI) and Equivalent Annual Cost (EAC) are your optimization toolkit, ensuring local production investments are not just viable (NPV, IRR) and timely (Payback, Discounted Payback) but also efficient and cost-effective.

In 2025’s tariff-driven economy, where every dollar counts, PI ranks projects by return per dollar invested, while EAC standardizes costs over time, crucial when tariffs distort long-term planning.

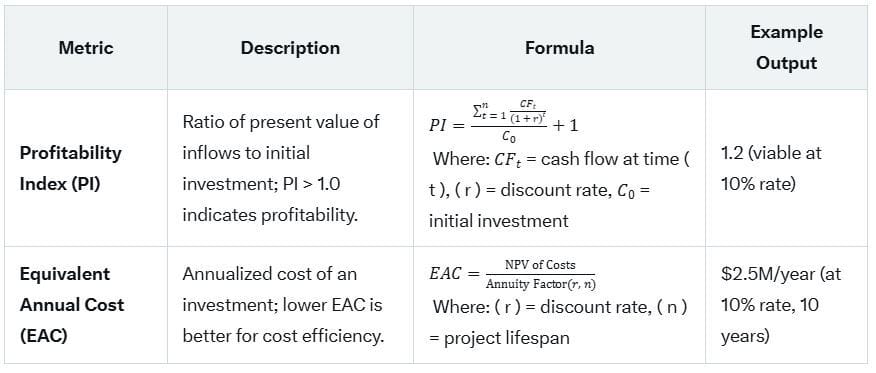

Unlike NPV and IRR, which focus on value, or Payback, which prioritizes speed, PI and EAC fine-tune efficiency—use PI for project ranking (e.g., PI > 1.0 for acceptance) and EAC for cost comparison across different lifespans, often alongside other methods for a holistic view. The techniques include:

Profitability Index (PI): Ratio of present value of inflows to initial investment; higher is better.

Equivalent Annual Cost (EAC): Annualized cost of an investment; lower is better

Value Proposition:

These metrics ensure you maximize returns and minimize costs, critical for mid-sized firms with limited resources compared to big players’ government support.

Profitability Index and Equivalent Annual Cost 101

Profitability Index (PI):

PI measures the ratio of the present value of future cash flows to the initial investment. It helps rank projects when capital is limited.

How to Apply:

Calculate the present value of future cash flows using the discount rate.

Divide the sum of discounted cash flows by the initial investment.

If PI > 1, accept the project; if PI < 1, reject it.

Equivalent Annual Cost (EAC):

Assess the annual cost associated with owning, operating, and maintaining an asset through its lifespan. As an essential tool in capital budgeting, EAC enables companies to evaluate and choose the most cost-effective assets, especially those with differing lifespans.

How to Apply:

Calculate NPV

Calculate the Present Value of Annuity Factor

Divide NPV by the Annuity Factor

Example:

PI Example: A $20M investment with $43.9M present value (at 10%) yields PI = 1.2—efficient!

EAC Example: Same $20M investment with $25M total costs over 10 years at 10% equals $2.5M/year—cost-effective.

Case Study: Toscana Imports’ Strategic Pivot

Toscana Imports, a U.S. arm of an Italian olive oil producer, imports 1 million liters annually at $10/liter ($10 million), but a 15% tariff adds $1.5 million, raising costs to $11.5 million.

Revenue holds at $15 million, yet price hikes risk losing customers amid 2025’s tariff volatility.

Option: Build a $20 million California facility with $8 million annual operating costs.

Profitability Index: PI=(43.9M/20M)+1=1.2—efficient, ranking high among options.

Equivalent Annual Cost: EAC = $2.5M/year, competitive against $3M/year import costs under 30% tariffs.

Why Methods Drive the Decision: PI ensures the $20M investment maximizes returns (1.2 vs. 1.0 threshold), while EAC confirms it’s cost-effective long-term ($2.5M/year vs. rising import costs). Without these, Toscana might overinvest in inefficient projects. The concept: optimize efficiency, with a clear result favoring local production.

Aha Moment:

PI and EAC turn trade uncertainty into efficient wins.

The Signals: When and Why to Use PI and EAC

When to Use PI and EAC:

Project Ranking: PI is ideal when choosing among multiple projects under budget constraints—use with NPV/IRR.

Cost Comparison: EAC suits long-term investments with different lifespans, enhancing Payback’s short-term view.

Efficiency Focus: Both are crucial when tariffs distort costs, ensuring maximum return and minimum expense.

The Manager’s Comprehensive Capital Budgeting Playbook: 6 Methods

Use this final 6-step playbook quarterly to master local production and thrive:

Step 1: Map Cash Flows

Estimate initial investment ($20M) and annual revenues/costs ($15M - $8M = $7M).

Step 2: Calculate NPV and IRR

NPV = $23.9M (viable at 10%); IRR = 35% (above 10% capital).

Why Matters: Assess long-term value and return.

When: Use for all projects, especially long-term.

Tool: Excel or our calculator.

Step 3: Calculate Payback and Discounted Payback

Payback = 2.86 years; Discounted Payback = 3.5 years (at 10%).

Why Matters: Ensure quick cash recovery under tariff pressure.

When: Use for short-term liquidity, often with NPV/IRR.

Step 4: Calculate Profitability Index (PI)

PI = 1.2 (efficient at 10%).

Why Matters: Rank projects for maximum efficiency per dollar invested.

When: Use for project selection under budget constraints, alongside NPV/IRR.

Step 5: Calculate Equivalent Annual Cost (EAC)

EAC = $2.5M/year (cost-effective at 10%, 10 years).

Why Matters: Standardize costs for fair comparison across projects.

When: Use for long-term cost efficiency, enhancing Payback’s view.

Step 6: Decide and Adapt

If NPV > 0, IRR > cost of capital, Payback < 5 years, PI > 1.0, and EAC is competitive, invest locally. Adjust with scenarios and stats.

Critical Insights: Lessons from the Trade Shift

Intel’s government stake and Tesla’s expansion underscore the efficiency race. PI and EAC complement NPV/IRR’s value and Payback’s speed, ensuring you optimize under 30% tariff threats. Statistics refine forecasts, per our prior series, while big firms’ government ties contrast mid-sized needs.

Manager Takeaway: Master all 6 methods to turn trade threats into wins.

What’s Your Efficiency Plan?

Share your optimization strategies on X. How are you tackling 2025 tariffs? Join the discussion!

Top Links to Deep Dive

Want to go beyond today’s breakdown? Here are the best resources to master this topic:

Cornell – Financial Management. Link here.

The Noble Manager – 2025 Trade Survival: Capital Budgeting for Local Production Now. Link here.

The Noble Manager – 2025 Trade Survival (part 2): Capital Budgeting for Local Production Now. Link here.

The Noble Manager – The #1 Sales Forecasting Mistake — and How Confidence Intervals Fix It. Link here.

The Noble Manager – Sales Forecasting Simplified: A 3-Step Framework for Better Decisions. Link here.

Final Thought

Trade shifts in 2025 demand bold moves—capital budgeting and statistical rigor are your key to navigating tariffs and securing local production success. Use all 6 methods to survive and thrive.

Until next time, keep innovating—and keep it noble!

Filippo Esposito

Founder, The Noble Manager