Good morning. It’s Wednesday, Feb. 19. Last week, we tackled a common mistake in sales forecasting—over-reliance on a single number—and how confidence intervals provide a better way to estimate uncertainty. (Missed it? Read here.)

Even the best sales forecast can fail if it ignores external factors like inflation, seasonality, market trends, and competitor pricing.

Today, we’ll explore why past sales data isn’t enough—and how Linear Regression helps managers predict sales more accurately.

Linear Regression:

Use Linear Regression to Analyze Past Trends and External Factors – Inflation, Seasonality, Economy – to Predict Future Sales.

Imagine setting your sales target based solely on last year’s growth rate—only to miss your goal because inflation spiked, a competitor dropped prices, or the economy slowed down.

This happens all the time.

Historical data only tells part of the story. It fails to account for market realities that directly impact demand. If inflation rises, customers may cut spending. If a competitor lowers prices, demand shifts.

Here’s the problem: Traditional sales forecasting ignores these external forces, leading to overoptimistic projections in strong markets and overly cautious estimates during downturns.

The solution? Linear Regression.

Unlike simple trend-based forecasting, Linear Regression connects past sales trends to external factors, revealing how economic shifts impact future revenue.

It helps managers:

Anticipate risks before they affect revenue

Refine pricing strategies based on external trends

Create forecasts grounded in market reality—not assumptions

Let’s break down the exact steps to set up a Linear Regression model for more accurate sales forecasting.

How to Define the Linear Regression Model:

Collect Past Sales Data & One External Factor.

Gather sales revenue data (monthly, quarterly, or yearly) for the past 3-5 years.

Choose one external factor that could impact sales, such as:

Inflation rate (economic impact)

Competitor pricing (market influence)

Fuel prices (affecting transportation costs & demand)

Input Data into Excel & Create a Scatter Plot

Enter your data:

Column B: Sales Revenue.

Column C: External Factor (e.g., Inflation Rate).

Highlight both columns, then go to Insert > Chart > Scatter Plot

A scatter plot helps visualize trends, showing whether an external factor positively or negatively impacts sales.

Add a Trendline to Identify the Relationship

Click on the scatter plot, select "Add Trendline."

Choose "Linear Regression" and check "Display Equation on Chart."

Interpret the trendline direction:

Sloping down? The factor negatively impacts sales (e.g., higher inflation = lower motorcycle sales).

Sloping up? The factor positively impacts sales (e.g., competitor price hikes = your sales increase).

Run the Linear Regression Analysis in Excel

Click on Data > Data Analysis > Regression.

Set Sales Revenue (Column B) as the dependent variable.

Set External Factor (Column C) as the independent variable.

Click OK to generate the regression output.

Interpret the Regression Results

Key values to focus on:

R-value (Correlation Coefficient) – Measures strength of the relationship (closer to 1 or -1 = strong, closer to 0 = weak).

R² (Coefficient of Determination) – Shows how much of the sales variation is explained by the factor (higher % = stronger impact).

P-value – Tests statistical significance (p < 0.05 means the factor is relevant, p > 0.05 suggests weak/no impact).

Use the Regression Equation for Sales Predictions

The regression formula is displayed on your chart or output:

Sales Forecast = (b × External Factor) + a

b = regression coefficient (how much sales change per unit of the external factor)

a = constant (baseline sales when the factor is 0)

Real-World Example: Optimizing E-Commerce Sales by Analyzing Website Engagement:

Let’s say you’re responsible for increasing sales on an e-commerce website that sells apparel and accessories in the U.S.

Instead of making changes based on assumptions, you decide to analyze how much time customers spend on the site and how it affects their purchases.

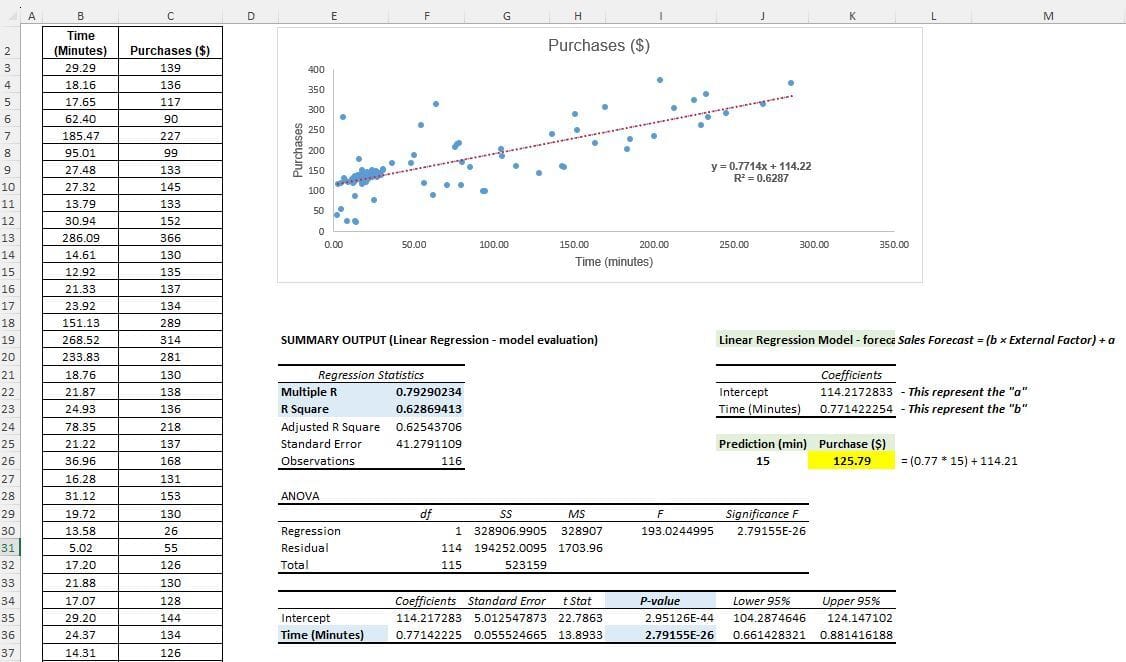

You run a Linear Regression analysis using data from 116 customers, tracking how long they navigated the website and how much they purchased.

Using Excel’s Regression Tool, you calculate the relationship between time spent on the website (X) and purchase amount (Y).

Key Results:

R = 0.79 → Strong positive correlation (more time spent = higher purchases).

R² = 0.63 → 63% of sales variation is explained by time spent on the website.

P-value = 0.000 → Statistically significant (this factor directly impacts sales).

Regression Equation:

Purchases ($) = 114.22 + (0.77 × Time Spent in Minutes)

Excel Example Linear Regression - download below (reply to this email to get the complete Excel Spreadsheet - 100% free)

How This Helps Decision-Making:

Your target average session time is 15 minutes, and you want to forecast the expected average purchase value

If the average visit lasts 15 minutes:

Predicted Purchase = 114.22 + (0.77 × 15) = $125.78If customers stay for 25 minutes:

Predicted Purchase = 114.22 + (0.77 × 25) = $133.49If the session time drops to 10 minutes:

Predicted Purchase = 114.22 + (0.77 × 10) = $121.92

This model provides the numbers you need to make informed, data-driven website optimization decisions.

Instead of relying on assumptions, you can use real insights to improve engagement and maximize sales—whether by enhancing product discovery to increase browsing time or introducing time-sensitive offers to drive faster conversions

Takeaway:

Linear Regression Shows How External Factors Impact Sales—And by How Much

The strength of Linear Regression is its ability to measure how much an external factor or customer behavior impacts sales. Instead of guessing, you can quantify the relationship between inflation, competitor pricing, seasonality, or any key driver and your revenue.

The e-commerce example demonstrated this clearly—increasing the average time spent on the website led to higher purchase amounts, and the model showed precisely by how much.

By applying the same approach to different factors, businesses can develop a sales forecast model that doesn’t just predict sales but helps refine pricing, inventory, and marketing strategies for real, measurable improvements.

Top Links of the Week

“Resource Guide - Linear Regression” (Northwestern) - A comprehensive directory with links to Linear Regression and Python-based applications. (link here)

“Regression Analysis to Forecast Sales” (HubSpot) - A real-world case study on how Linear Regression is used in marketing and sales forecasting. (link here)

“A Refresher on Regression Analysis” (HBR) - A deep dive into Regression Analysis, breaking down its key concepts and business applications. (link here)

Conclusion:

Linear Regression Transforms External Factors into Actionable Sales Insights

Forecasting based on past data and confidence intervals is the first step toward better predictions—it helps quantify uncertainty and set realistic expectations. But to truly refine sales forecasts, the next step is understanding how external factors influence demand.

Linear regression provides the framework to measure these influences, helping managers adjust pricing, plan inventory, and prepare for market shifts before they happen. Instead of relying on gut feeling, businesses can make informed decisions grounded in data.

But identifying external factors is just part of the equation. The final question is: Which levers—like ad spend, pricing, or sales team performance—have the biggest impact on sales?

Next week, we’ll dive into Strategy 3: How Multiple Regression Helps Pinpoint Which Actions—Like Ad Spend, Pricing, or Sales Team Performance—Will Have the Biggest Impact on Sales.