Good Morning, Noble Managers! It’s Wednesday, May 28.

Topic: Economic Analysis | Decision-Making | Strategic Planning

For: B2B and B2C Managers.

Subject: Economics → Practical Application

Concept: Build a framework to read the economy using signals

Application: Use key indicators and scenario planning to make confident decisions

Don’t keep us a secret. Share this newsletter with friends (copy URL here).

TL;DR:

Why economic signals, not noise, drive smart decisions

How to read the economy with 10 key indicators. A step-by-step process

How to apply it in 2025’s uncertain landscape

Introduction

In today’s volatile economy, making decisions based on headlines or gut feelings is a recipe for trouble.

With tariffs rising, inflation sticky at 3.8%, and consumer confidence falling (Deloitte Insights), managers need a better way to navigate uncertainty.

The answer?

A framework to read the economy using signals, not noise.

By focusing on key indicators like CPI, M2, and credit growth, you can spot risks and opportunities before they hit.

60% of CEOs who use data-driven economic analysis outperform their peers in downturns

Let’s build a framework to assess the macro environment, interpret signals, and act with confidence, no matter what 2025 throws at you!

Why Signals Matter: A Wake-Up Call

Imagine you’re the CEO of a mid-sized B2B manufacturing firm in early 2025.

Your sales team reports strong orders, but your CFO flags a problem: receivables are slowing, and suppliers are raising prices due to new tariffs on China.

You dig into the data:

CPI: 3.8%—inflation is persistent.

M2: Flat—liquidity isn’t growing.

Credit Growth: Down—banks are tightening lending.

Consumer Confidence: Falling—your clients are hesitant to invest.

Without a framework, you might focus on the strong orders and miss the bigger picture: a cash crunch is looming.

By reading these signals, you act early, securing a line of credit, negotiating vendor terms, and pausing expansion.

This saves your firm from a liquidity crisis as the economy tightens in mid-2025.

Part 1: Key Indicators to Watch

Here are 10 core indicators to assess the macro environment:

Part 2: Step-by-Step Process

Tactical tool: Signals Scorecard. Link here.

Assess your economic risk level with this scorecard. Answer yes/no:

Is CPI above 3% and rising?

Is M2 flat or declining?

Is velocity of money dropping?

Are interest rates (Fed Funds) above 5%?

Are corporate credit spreads widening?

Is consumer confidence falling?

Is bank lending slowing?

Are tariffs increasing significantly?

Is PPI rising faster than CPI?

Are job openings declining while unemployment rises?

Risk Levels:

Risk Level | Score | Action |

|---|---|---|

Green | 0-3 | Low risk—proceed with confidence |

Yellow | 4-6 | Moderate risk—monitor closely, adjust |

Red | 7-10 | High risk—preserve cash, scenario-plan |

Assess your risk in just 3 minutes with our interactive Signals Scorecard! Take the Scorecard Now. Link here.

Share your risk level on X with #NobleEconomy—I’d love to see your score! (tag @EspositoFilippo)

Download the Scenario Planning Checklist:

The Process: 4 Steps to Act on Signals

Step 1: Get a Macro Snapshot (Monthly)

Are inflation and rates rising, stable, or falling?

Is liquidity (M2, credit) expanding or contracting?

What’s happening with trade and fiscal policy?

Step 2: Interpret the Signals

Step 3: Segment Impact by Function

Supply Chain: Are input prices rising? Stock up or renegotiate.

Sales: Are consumers confident? Adjust forecasts.

Cash Flow: Are receivables slowing? Lock in financing.

Hiring: Is labor tightening? Retain talent now.

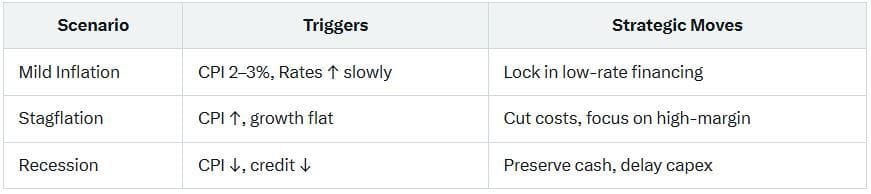

Step 4: Build Scenario Plans

Part 3: Apply to 2025 Conditions

Here’s the U.S. economy in mid-2025:

CPI: 3.8%—persistent inflation Deloitte Insights.

M2: Flat—liquidity isn’t expanding.

Credit Growth: Down—banks are tightening.

Consumer Confidence: Falling—retail and services under pressure.

Fed Funds Rate: 5.25%—restrictive policy continues.

Oil/Food: Volatile—supply shocks persist.

Tariffs: Up on China/EVs—cost pressure rises.

Interpretations:

High rates and tight credit signal a restrictive environment.

Sticky inflation is supply-driven (tariffs, oil volatility), not demand-driven.

Falling confidence points to weaker discretionary spending.

Margin pressure continues with volatile input costs.

Strategic Recommendations:

Preserve Liquidity: Prioritize short-term cash over long-term capex.

Negotiate Terms: Lock in pricing with vendors now.

Pause Expansion: Wait for clear demand signals or contracts.

Finance Opportunistically: Secure credit if terms are favorable.

Scenario-Plan for 2H 2025: Prepare for easing (Fed pivot) or worsening (election impact).

3 Critical Insights for Decision-Making

Signals Beat Noise

Focus on data (CPI, M2) over headlines—60% of CEOs who do this outperform peers.

Timing Is Everything

Acting early on signals (e.g., credit tightening) can save your cash flow.

Functions Feel It Differently

Inflation hits supply chains first—protect margins before demand drops.

What’s Your Economic Risk Level?

Did you score Green, Yellow, or Red on the Signal Scorecard? Reply or share on X—I’d love to hear how this playbook can help!

Top Links to Deep Dive

Want to go beyond today’s breakdown? Here are the best resources to master this topic:

Google Cloud – Big on data: Study shows why data-driven companies are more profitable than their peers. Link here.

CIO – Data-Driven Companies Outperform Competitors Financially. Link here.

Deloitte Insights – Tariffs will impact the economy … and so will uncertainty. Link here.

Deloitte Insights – Weekly global economic update. Link here.

Yahoo Finance – Consumer confidence plunges most in nearly 4 years as inflation fears escalate on Trump tariff threats. Link here.

Final Thought

The economy doesn’t care about your guesses; it rewards those who read the signals and act decisively. Build a framework that cuts through the noise, not one that drowns in it.

Until next time, keep innovating—and keep it noble!

Filippo Esposito

Founder, The Noble Manager